Madrid, August 2023 - Astris Finance congratulates its client Bruc on the successful closing of a EUR 600m sustainable corporate financing for its renewable platform of 8.5GW in Spain.

We are very pleased to announce the signing of the transaction for which we supported Bruc, a Madrid-based renewable energy company managing solar PV and wind assets under development, construction and operation, in raising a sustainable corporate debt facility of EUR 600m to fund the construction of c. 8.5GW of solar PV and onshore wind located in several Spanish regions.

Santander, ING, Instituto de Credito Oficial, BNP Paribas and Intesa Sanpaolo acted as bookrunners and MLAs, and Schroders and Infranity as MLAs.

Because it complies with strict ESG criteria, the financing agreement has been substantiated under the formula of "sustainable corporate financing". This confirms Bruc's strong positioning in the clean energy sector -- a key aspect for OPTrust and USS to enter the company's capital in 2016 and 2021 respectively.

This transaction further consolidates Astris’s positioning in Spain where it closed 7 financings adding up to EUR 1.2bn in the Energy Transition space over the last 18 months.

Astris Finance acted as exclusive financial advisor to Bruc.

July 2023 - Astris Congratulates its Client Banque des Territoires for the Successful Acquisition of an Equity Stake in JP Energie Environnement (« JPEE »)

Paris, July 2023 - Astris Congratulates its Client Banque des Territoires for the Successful Acquisition of an Equity Participation in JP Energie Environnement (« JPEE »)

We are pleased to announce the closing of Project Bombay, for which Astris advised Banque des Territoires, the investment arm of the State-owned banking group Caisse des Dépôts, in the acquisition of a 34% equity stake in the French company JPEE.

JPEE is a French IPP of wind and solar energy, who produced 680,000 MWh in 2022, the equivalent of the annual consumption of more than 300,000 households. The aim of the partnership between JPEE and Banque des Territoires is to double the installed capacity to reach 1 GW of projects in operation in 2026 and 2 GW by 2030, which will allow JPEE to supply green electricity to 1.6 million households.

Cédric Desmedt, Deputy Director of Energy Transition at Banque des Territoires says: "We are delighted to be a part of JPEE, a leading developer on the French market; this transaction consolidates a relationship of trust of more than 10 years, guided by strategic alignment and common values. We would also like to thank the Astris team for the instrumental role they played all along the transaction».

Astris acted as exclusive financial advisor to Banque des Territoires. This landmark transaction reinforces Astris’s premier position in the European renewable M&A sector and further strengthens our relationship with Banque des Territoires in the context of its ambitious positioning to fund the green energy transition.

June 2023 - Astris Advises Générale du Solaire in Setting Up a Strategic Partnership with Banque des Territoires

Paris, June 2023 - Astris Finance congratulates its client Générale du Solaire (“GdS”), a leading French independent solar power producer (IPP) for the signing of a long-term partnership agreement (the “Partnership”) with Banque des Territoires, the investment arm of the State-owned banking group Caisse des Dépôts.

In its first phase, the Partnership consists of the acquisition by Banque des Territoires of a 49% stake in a platform of 83 solar assets located in France, representing a cumulative capacity of approximately 270 MWp. It will then be fed by new solar projects developed by GdS, with the objective to finance 1 GW of solar projects over the next 5 years in France, representing the annual consumption of 300,000 homes. This partnership allows GdS to strengthen its investment capacity and accelerate its development in a very dynamic sector, while maintaining its independence and act for the quick deployment of solar energy in France.

"This partnership with Banque des Territoires is an important step in the young life of Générale du Solaire and a great recognition of our development model. I would like to thank Astris Finance teams for their very valuable advice along the transaction" says Daniel Bour, GdS’ Chairman.

Arnaud Germain, co-head of Europe at Astris, said: “This project is a great achievement for our client. We are happy we played an instrumental role in the design and implementation of this partnership. We would like to thank Daniel Bour and his team for their trust.”

Astris acted as exclusive financial advisor to Générale du Solaire. This landmark transaction further demonstrates Astris’s premier position in the European renewable M&A sector, where we have closed 10 transactions over the last 12 months.

May 2023 - Astris Finance Congratulates Q ENERGY France for the Successful Debt Closing of EUR 96m for a 73MWp Solar PV and Wind Portfolio Located in France

Paris, May 2023 - We are pleased to announce the closing of the Falcon project in which we assisted Q ENERGY France (ex RES France), a French leading developer fully owned by the Korean conglomerate Hanwha, in the EUR 96m financing of a 73MW solar PV and wind portfolio composed of 4 projects located in France.

Three assets are benefiting from 20y CfDs with EDF and one solar PV plant has secured a 15y corporate PPA. Two projects reached COD in the course of 2022, while the two remaining assets will be commissioned by Q1 2024. Some assets of the portfolio are eligible for the emergency measures announced by the French government last summer.

The EUR 96m facilities were provided by Credit Agricole Unifergie as sole lender.

Astris Finance acted as exclusive financial advisor to Q ENERGY France in the structuring of the transaction until financial close, the whole process having been completed within a record timeframe of less than 3 months.

April 2023 - Astris Finance Congratulates its Client Third Step Energy for the closing of a €130 million Capital Raise

Paris, April 2023 - Astris Finance congratulates Third Step Energy (“TSE”), a leading independent solar energy player in France, for the closing of a €130 million capital raise which will strengthen TSE’s position as a major player in the energy transition in France through the rapid growth in the development of photovoltaic and agrivoltaic solar projects.

The €130 million capital comes from three major players in the energy transition: Eurazeo, Bpifrance and a pool of investors from the Crédit Agricole group, represented in particular by IDIA Capital Investissement and Amundi.

Mathieu Debonnet, founder and CEO of TSE stated: “I would like to thank the Astris Finance team as they’ve structured and processed the capital raise in a very efficient manner. This new capital will allow us to continue to develop according to our model based on quality, long-term local commitment and to actively contribute to the decarbonization of our economy”.

Arnaud Germain, who heads Astris Finance’s operations in France and Germany, said: “We are very happy we advised TSE on this transaction, which will be instrumental for their future development. We would like to thank Mathieu Debonnet, Pierre-Yves Lambert and Frédéric Nicolas for their trust in Astris since our first collaboration back in 2019.”

Astris acted as exclusive financial advisor to TSE. This landmark transaction reinforces Astris’s premier position in the European renewable M&A sector and further strengthens our relationship with TSE who aims at developing 10 GW of solar projects in the next 10 years.

March 2023 - Astris Finance Congratulates its Clients MER and SMEG for the EUR 60m Refinancing of a Solar Portfolio Located in France

We are pleased to announce the closing of the Herculis project in which we assisted Monaco Energies Renouvelables (“MER”), a platform owned by the Principality, and the Monegasque utility SMEG, the historical concessionaire in Monaco responsible for the distribution and supply of electricity and gas for over 130 years, in the EUR 60m refinancing of a 82 MW Solar portfolio of 12 projects located in France.

The transaction was arranged and financed by Société Générale and Unifergie, the facilities being backed by 8-12y feed-in tariffs from EDF OA and forward medium-term power purchase agreements. This innovative refinancing structure provides substantial benefits to Sponsors despite higher financing costs due to the macroeconomic context.

Astris acted as exclusive financial advisor to MER/SMEG. This transaction further strengthens Astris France’s long track record in refinancings.

March 2023 - Astris Finance Congratulates its Client CVE for the Closing of a EUR 100m Capital Raise

Astris Finance congratulates its client CVE, a French renewable energy independent producer, for the closing of a capital raise whereby Intermediate Capital Group plc (ICG) will invest EUR 100m in CVE to finance their expansion.

This new equity injection will fund CVE's growth in areas such as biogas and agrivoltaics in France as well as solar activities in Chile and the US. More generally it will fund CVE's ambitious development plan, aiming at multiplying by four its installed solar capacity to reach 2.7 GW by 2027 and by 8 its biogas capacity to reach 1.5 TWh by 2030.

Pierre de Froidefond, founder and co-chairman of CVE stated: “Thanks to Astris’ financial advice, this operation was set up in a short time frame. It will allow us to continue our development, in a global economic context where the need for renewables is exploding”.

Arnaud Germain, who heads Astris Finance’s operations in France and Germany, said: “We want to thank CVE and more particularly Pierre de Froidefond, Hervé Lucas and Arnaud Réal del Sarte for their confidence in Astris Finance’s capacity to help them close such an important transaction for their development plan. We are very proud to have successfully advised CVE to design and setup this capital raise with a strong partner such as ICG.”

Astris acted as exclusive financial advisor to CVE. This landmark transaction further demonstrates Astris’s premier position in the European renewable M&A sector, where we are advising on four transactions of similar nature, that are slated to close in the next 3 months.

December 2022 - Astris Finance congratulates its client Altano Energy on the successful financing of a 107.6MW solar and hydro portfolio in Spain

We are pleased to announce the closing of the Nimbus financing where Astris advised Altano Energy, the renewables investment platform backed by UK firm Pioneer Point Partners, in relation to the total financing of an installed hybrid capacity of 107.6 MW, comprising 11 operating hydro plants and a solar PV plant to be operational by 2024.

The project revenues will benefit from a long-term PPA for the entire portfolio, taking advantage of the complementary mix of technologies and geographical diversification.

This unique and innovative financing brings several important benefits for Altano Energy in terms of structure, leverage and cash flow stability for the shareholder. The transaction was arranged and financed by Santander Corporate & Investment Banking, which provided the +90M€ senior financing facilities.

Astris Finance acted as exclusive financial advisor to Altano Energy.

December 2022 - Astris advises Vauban in connection with the acquisition of a portfolio of 3 windfarms totaling 170MW located across the Nordics

Astris Finance congratulates its client Vauban Infrastructure Partners (“Vauban”), a leading European infrastructure & energy investment fund, on the acquisition of 100% of Nordic Renewable Power Holding (“NRPH AB”) from Green Investment Group.

NRPH AB is a portfolio of three windfarms located across the Nordics. The three windfarms, totaling 40 wind turbines for an aggregated capacity of c. 170MW, are fully operational and contribute to provide sustainable energy solutions to local communities and industrial players in the region.

The portfolio is backed by a solid contractual framework with long term operating contracts with leading players and long term offtake agreements with high creditworthiness counterparties.

Astris acted as exclusive financial advisor, supporting Vauban from the binding offer of the transaction until first disbursement.

This landmark transaction further demonstrates Astris’ premier position in the European renewable energy advisory market, where we are currently advising across 8 different countries.

October 2022 - Astris Finance congratulates its client Amarenco on the successful financing of a 80MW solar PV portfolio in Spain

We are pleased to announce the closing of Project Guadiana in which Astris assisted Amarenco, a leading, Irish-based Solar IPP, in the financing of a portfolio of solar assets.

The transaction includes the refinancing of a 49MW project that has been operating since March 2021 and the financing of two greenfield solar projects, with an aggregate installed capacity of 80MWp. Signing of the financing facilities occurred in June and this month the last project of the portfolio reached financial close which enables Amarenco to fully utilize the 45M€ senior financing facilities.

In addition to the senior facilities, Astris assisted Amarenco to recycle the bridge loan that was raised to finance construction into a mezzanine facility, leading to a total debt package of 82M€. The projects will benefit from a short-term PPA.

The Guadiana transaction is part of a pipeline of Solar PV ground-mounted assets that Amarenco is currently developing in Spain.

The new financing brings several important benefits to Amarenco in terms of structure, leverage, and cash flow stability for the shareholder. The senior financing facilities have been provided by Rabobank, Unicredit and ING.

Astris Finance acted as exclusive financial advisor to Amarenco.

October 2022 – Astris Finance Congratulates Q-Energy for the Successful Debt Closing of EUR 96m for a 113MWp (87 MWac) Solar PV Project Located in Poland

The solar PV plant will be located in Milkowice, Poland, with a total installed capacity of 113MWp (87 MWac). It is the first project that Q-Energy builds in Poland and one of the largest solar PV plants in Poland to date.

The transaction is a pathfinder in the Polish renewable space, with a Euro-denominated PPA and a Euro-denominated financing. The € 96 m term facility was provided by PKO BP as sole lender.

The Project is currently being constructed and completion is expected to be achieved in December 2024. The energy generated by the solar farm will be sold to Amazon under a long-term, corporate power purchase agreement (CPPA). Amazon is the world's largest corporate purchaser of renewable energy and this CPPA will help Amazon on its path to power its operations with 100% renewable energy by 2025, five years ahead of its original target of 2030.

Astris acted as exclusive financial advisor to Q-Energy in the structuring and closing of the transaction. Since 2018, Astris has developed a significant expertise in the Polish renewable energy sector: we have closed 7 debt financing and M&A transactions in this market for an aggregate value of close to € 1 bn, and our teams are currently managing 3 active processes.

October 2022 - Astris advises DIF Capital Partners for the closing of a partnership agreement with the leading global renewable energy platform Qair

Astris Finance congratulates its client DIF Capital Partners (“DIF”), a leading global independent investment manager, for the closing of a partnership agreement whereby DIF will invest in Qair, a fast growing renewable energy platform company, to accelerate its growth and portfolio build out.

The transaction, which closed in September 2022, took the form of a minority investment by DIF, through DIF Infrastructure VII, in the platform owning the assets.

The platform is focused on a wide range of technologies including onshore as well as offshore wind, utility scale solar, energy from waste, hydroelectricity, storage, hydrogen production, as well as tidal energy. The operational portfolio of ca.1 GW is mainly comprised of onshore wind for c. 75% and solar projects, and the development pipeline capacity amounts to up to 25 GW.

Astris acted as exclusive financial advisor to DIF. Astris has a long-standing relationship with DIF, for which it has acted as exclusive advisor on several M&A and senior debt financing transactions over the past few years.

This landmark transaction strengthens Astris’s position in the European renewable sector, where we have executed 12 transactions since January 2022 (out of which 7 in the M&A space) and are currently managing several processes in France, Spain, Italy and Germany.

September 2022 - Astris Finance congratulates its client Equitix for the successful refinancing of the Grünwald geothermal plant in Germany.

Following the acquisition of the Geothermische Kraftwerksgesellschaft Traunreut mbH (“GKT”) from Grünwald Equity in Q1 2022, Equitix has now reached financial close on the refinancing. Astris acted as exclusive financial advisor to Equitix on both processes.

GKT is a geothermal combined heat and power generation facility connected to a district heating network in Bavaria, Southern Germany. The plant was commissioned in 2014 and currently has 42 years of remaining operating life, its primary objective being the production of electricity and heat from thermal brine energy. The facility has an electricity generation capacity of 5.5 Mwel, with an expected yearly production of c. 34 GWh, and a heat generation capacity of 12 MWth, with an expected yearly production of c. 43 GWh. The project will help avoid c. 20kt of CO2 emissions per year.

”We are very pleased we advised Equitix in connection with the refinancing of this combined heat and power geothermal plant in Germany. The transaction shows the attractiveness of refinancings for operational assets benefitting from a strong feed-in-tariff framework.” said Theoharis Saroglou, Director of Astris's Hamburg office.

This is the third successful closing for Astris Germany in 12 months. Currently Astris Germany is advising clients both on the financing of large-scale greenfield projects and on renewable energy M&A processes.

June 2022 – Astris #1 in the 2021 IJ Global League Table for European Renewable Energy Financial Advisory

Here is a piece of good news, just before the first semester of 2022 ends: we are delighted to report that -- for the first time since its creation over twenty years ago -- Astris reached the top spot in the 2021 IJ Global League Table for European Renewable Energy financial advisory.

This top position rewards an exciting year 2021 for Astris in Europe where we helped bring eighteen transactions to closing in France, Spain, Germany, Poland and Italy. These include a wide array of deals, both on the financing side (development stage advisory, debt and equity raising) with EUR 3bn raised, and on the M&A side (sell-side, buy-side, investor solutions).

Since 2011, Astris has built an unparalleled track record in the European market from its offices in Paris (2011), Madrid (2017) and Hamburg (2020): in the past 5 years, we have closed over 40 M&A transactions for a combined enterprise value of 10+ bn€ and 50 financing transactions with 9+ bn€ of debt raised.

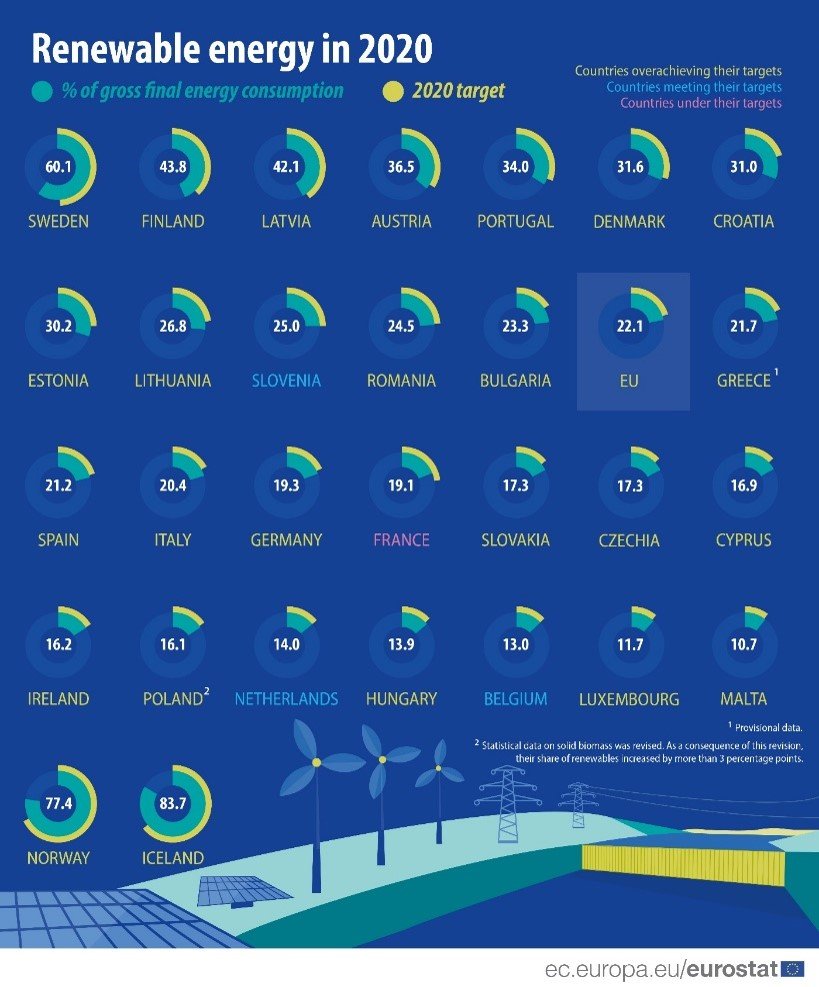

The coming years will be fascinating when it comes to the European renewable energy sector. The “RE Power EU plan” published by the European Commission in May 2022 establishes a three-pronged strategy to drastically reduce Europe’s dependence on Russian fossil fuels: energy savings, acceleration of renewable energy deployment, and diversification of energy sources. Under the second pillar, the Commission increased the target share of gross final energy consumption from renewable sources to 45% by 2030 from just 22% in 2021.

This very ambitious growth will require reaching an aggregate renewable energy generation capacity of 1236 GW by 2030 – an increase of more than 700 GW compared with the installed capacity at the end of 2020. That is fully 100 GW per year! (Source: EU Commission, Eurostat, 2022)

This increased installed capacity will need to come hand in hand with new business models and technologies such as storage, smart grid, peak shaving and demand-side management, EV charging, hydrogen storage, etc. Astris hopes to do its share, however modest, to help achieve this existential challenge!

Thomas Innocenzi, Head of European Operations for Astris said: “As we continue strengthening our position in the European renewable energy space, we would like once again to thank all of our clients and partners for the solid relationships we have established over the years as well as our team for the rigor, creativity and energy deployed on every one of our mandates.”

May 2022 - Astris Finance advises on partnership for 400 MW+ ready-to-build solar portfolio in Spain and Italy.

The recent acceleration of government deployment targets for renewable projects in Europe, boosted by the current geopolitical situation of the continent, is leading to an increasing number of transactions whereby local developers syndicate their equity interest in their development portfolio to financial or strategic investors, typically at Ready-to-Build (RtB) stage.

The Spanish market is particularly well suited for this type of partnerships given the strong local hurdles that must be overcome to bring projects to RtB, notably in terms of access to the grid. In this specific transaction, Astris advised the developer in the structuring and placement of an efficient co-investment by a financial investor to recycle the client’s development equity investment in a 400+ MW pipeline located in Spain and Italy -- allowing our client to accelerate the growth of their development pipeline.

Gonzalo Ruiz de Angulo, Head of Astris Finance for Spain, Portugal and Poland, said: “We are very pleased we were able to structure the right partnership and source the right partner for our client. The partner brings competitive long-term capital and in exchange gets access to a quality pipeline of RtB projects. This transaction confirms that the RtB stage is a nice meeting point for developers and investors in terms of risk-return combination in the Southern Europe renewable sector.”

Astris Finance acted as exclusive sell-side financial advisor on the transaction. This is the seventh European renewable partnership on which Astris advised on the sell side in the past 24 months.

March 2022 – Astris Finance Congratulates its Clients Prosolia Energy and Omnes Capital for the Successful Debt Closing of a 63MW Solar Portfolio of Projects located in Spain and Portugal.

The three solar PV plants are located in Spain and Portugal with total installed capacity of 63MW, adding a significant number of megawatts to Prosolia’s 200MW portfolio. These projects are a first step within a strategic agreement between Prosolia Energy and Omnes Capital for the development, construction, and operation of a portfolio of utility-scale solar projects of more than 2GW in Europe. The senior debt facilities were provided by Sabadell.

The Spanish project has secured a 12-year tariff through a government-sponsored renewable auction, while the two Portuguese projects will benefit from merchant revenues only. The projects are expected to reach COD during the course of Q1 2023.

Astris acted as exclusive advisor to Prosolia Energy and Omnes Capital on the senior debt raising for this first batch of projects currently being developed by Prosolia Energy. Since 2017, Astris has developed a deep expertise in the Iberian renewable energy sector and has closed over 10 financing and M&A mandates.

March 2022 – Astris Finance Congratulates its Clients Valeco, Mirova and GEG for the Successful Refinancing of a 220MW Wind and Solar Portfolio

We are pleased to announce the closing of the “Lily” project in which we assisted Valeco, a French leading developer, fully owned by the German utility EnBW, Mirova, a French leading asset manager with a significant footprint in the European renewable space, and GEG, a local French developer and electricity provider, in the EUR 300m refinancing of a 220MW wind and solar portfolio composed of 13 projects located in France and benefiting from 15-20y CfDs with EDF.

Project Lily consisted in the refinancing of three sub-portfolios which have been structured based on the existing ownership of the projects, for a total debt amount of EUR 300m. The new financing brings several important benefits for the sponsors: a maturity extension, a lower debt service coverage ratio, the replacement of the existing DSRAs by an unfunded DSRF, the implementation of an optimized and flexible financing structure and a significant reduction in financing costs. The transaction was arranged and financed by Crédit Agricole Group, Caisse d’Epargne CEPAC and BPI.

Astris Finance acted as exclusive financial advisor to Valeco, Mirova and GEG.

February 2022 - Astris Finance congratulates its client Equitix for the successful acquisition of the Grünwald geothermal plant in Germany.

Astris advised Equitix on the acquisition of 100% of the shares in Grünwald Equity Geothermie GmbH (“GET”). The plant was sold by Grünwald Equity. Astris Finance acted as buy-side financial advisor to Equitix.

GET is a geothermal combined heat and power generation facility connected to a district heating network in Bavaria, Southern Germany. The plant was commissioned in 2014 and currently has 42 years of remaining operating life, its primary objective being the production of electricity and heat from thermal brine energy. The generation facility has an electricity generation capacity of 5.5 Mwel, with an expected yearly production of c. 34 GWh, and a heat generation capacity of 12 MWth, with an expected yearly production of c. 43 GWh. The project will help avoid c. 20kt of CO2 emissions per year.

”We are very pleased we advised Equitix in connection with the acquisition of this combined heat and power geothermal plant in Germany. The transaction shows the attractiveness of the German market and underpins once again that international investors are keen to invest in operational assets which benefit from a strong feed-in-tariff framework.” said Theoharis Saroglou, Director of Astris's Hamburg office.

This is the second successful closing for Astris Germany in six months, following the Q4-2021 closing of the sale of a wind portfolio managed by German asset manager KGAL to Italian renewable IPP ERG, for which Astris acted as sell side advisor to KGAL.

November 2021 – Astris Congratulates its Client Marguerite for the Successful Acquisition of an Equity Participation in ZE Energy

We are pleased to announce the closing of Project Zeus, for which Astris advised Marguerite, a leading European investment fund. The transaction consisted in the acquisition of an equity stake in French company ZE Energy through a capital increase. Astris acted as exclusive financial advisor to Marguerite.

ZE Energy was founded in 2019 by an experienced management team of former Solairedirect and Engie employees. It is an integrated solar-plus-storage developer whose business model relies on a combination of solar PV, battery and aggregation activities. Its main markets are France, Spain, the UK, Italy and Germany. Through this capital increase, Marguerite will own a significant stake in ZE Energy, alongside existing investors.

This landmark transaction further strengthens our relationship with Marguerite, whom we advised two years ago for the sale of their French solar portfolio. It will also undoubtedly pave the way for additional work in the fast-growing storage sector.

November 2021 - Astris Finance congratulates its client Urbasolar for the sale of two French greenfield solar portfolios representing c. 400MW

November 2021 - Astris Finance congratulates its client Urbasolar, one of the largest vertically integrated solar power producers in France, 100% owned by Axpo (the largest Swiss producer of electricity from renewable sources) for the signing of the Cassiopée Transaction, which consisted of the sale of a participation in two French greenfield solar portfolios with an aggregate capacity of c. 400MW to Predica (Crédit Agricole Assurances), a leading French insurance company. Astris acted as exclusive financial advisor to Urbasolar.

The acquisition, made by a dedicated vehicle named PredUrba, is the first milestone of an ambitious partnership agreed between the two parties, in which Predica will have the opportunity to acquire up to 2.4GW of solar assets located in France and potentially other European countries in the next 3 years.

"Since the beginning of 2020, it is the fifth partnership between a renewable energy developer and a financial investor which Astris has successfully arranged. This trend illustrates the growing interest of the market for these partnerships, which are a clear win-win proposition: they allow the developer to finance its growth by accessing equity at a competitive cost from an experienced investor, and they allow the investor to deploy liquidity by accessing a diversified pool of low risk renewable projects from an experienced developer," says Arnaud Germain, Head of Astris France & Germany.